Introducing Mizu: A Unified Liquidity Layer for any VM

Published: 12/18/2024

The fight for liquidity has become a war of attrition.

The blockchain landscape is experiencing unprecedented growth, with new VMs emerging daily. While this expansion brings innovation, it also introduces a critical challenge: the increasing fragmentation of liquidity. Today's DeFi users face a zero-sum decision - choosing which chain to deploy their capital on, often at the expense of opportunities elsewhere.

Users waste time, money and effort through unsustainable incentive programs. When ecosystems cease to compete for liquidity, more novel architectures can be created to onboard new users.

But what if there would be a modular chain that enables this innovation, onboarding the next wave of users?

Enter Mizu, a modular chain that unifies liquidity across chains, optimizes cross-chain yield that brings about a capital efficient marketplace.

Reimagining Liquidity for the Modular Era

More than another bridge or liquidity solution, Mizu aims to become a comprehensive infrastructure layer that unifies liquidity across all virtual machine (VM) environments while maximizing yield potential.

Instead of competing with the thousands of strong chains and interoperability solutions out there, Mizu is a complimentary and supportive architecture that unifies liquidity.

Mizu introduces three core innovations:

- Unified Cross-Chain Liquidity

- With Router protocol as an interoperability partner, we unify liquidity into a single source across all connected chains with Mizu’s PoP logic

- Seamless access to global liquidity pools

- No more fragmented wrapped tokens

- Capital-Efficient Yield Generation

- Native, risk-free 2x leverage on deposited collateral

- Perpetually optimized yield on interconnected chains

- Proof of Presence (PoP) mechanism for maximizing returns

- VM-Agnostic Architecture

- Support for EVM, non-EVM & altVM environments

- Parallel execution capabilities

- Optimized data availability through Avail DA, allowing Mizu to be more efficient and reliable

The Technical Foundation

At its core, Mizu is built as a modular MoveVM, leveraging Movement Labs' infrastructure to enable:

- Atomic Cross-Chain Execution: Ensuring transaction consistency across different chains

- Smart Contract Composability: Maximizing capital efficiency through automated routing

- Parallel Transaction Processing: Higher throughput and lower latency while maintaining security

Beyond Traditional Liquidity Solutions

Mizu's architecture represents a paradigm shift in how we think about cross-chain liquidity:

- Auto-Yield Router: Intelligent contract-level composability for optimal capital deployment

- Concentrated & Fractional Positions: Advanced liquidity management across various DeFi protocols

- Unified Liquidity with Mirror token logic ( PoP ): Single entry point for all cross-chain liquidity needs

Mizu’s Proof-of-Presence (PoP):

A first for the DeFi space, Mizu introduces the use of Trust-minimized canonical bridges to interweave user deposits from Shinkai Vaults into Mizu Chain. Mizu leverages infrastructure from interoperability partners like Router Protocol to maintain maximal capital efficiency and risk-adjusted yields on all user funds. This is one of the key concepts interweaving Mizu with external blockspace and uniting liquidity across networks.

PoP enables users to get optimally risk-adjusted yields on their Gateway deposits whilst having access to 100% of the collateral they deposit. User deposits are minted 1:1 as yield bearing collateral on Mizu Chain after a short settlement period and can be converted/withdrawn back anytime.

The settlement period is in place to achieve consensus on state between all integrated Chains and Mizu.

Unified liquidity anytime, anywhere & for everyone

- Users: Eliminates the need for trust in a single authority, empowering individuals and organizations to connect into a unified liquidity across the Web3 ecosystem.''

- Developers: Build with instant access to unified liquidity, no time consumed for liquidity bootstrapping, more efforts to enhancing consumer based dApps on Mizu MoveVM

- Protocols: Tap into unified liquidity markets regardless of their VM environment

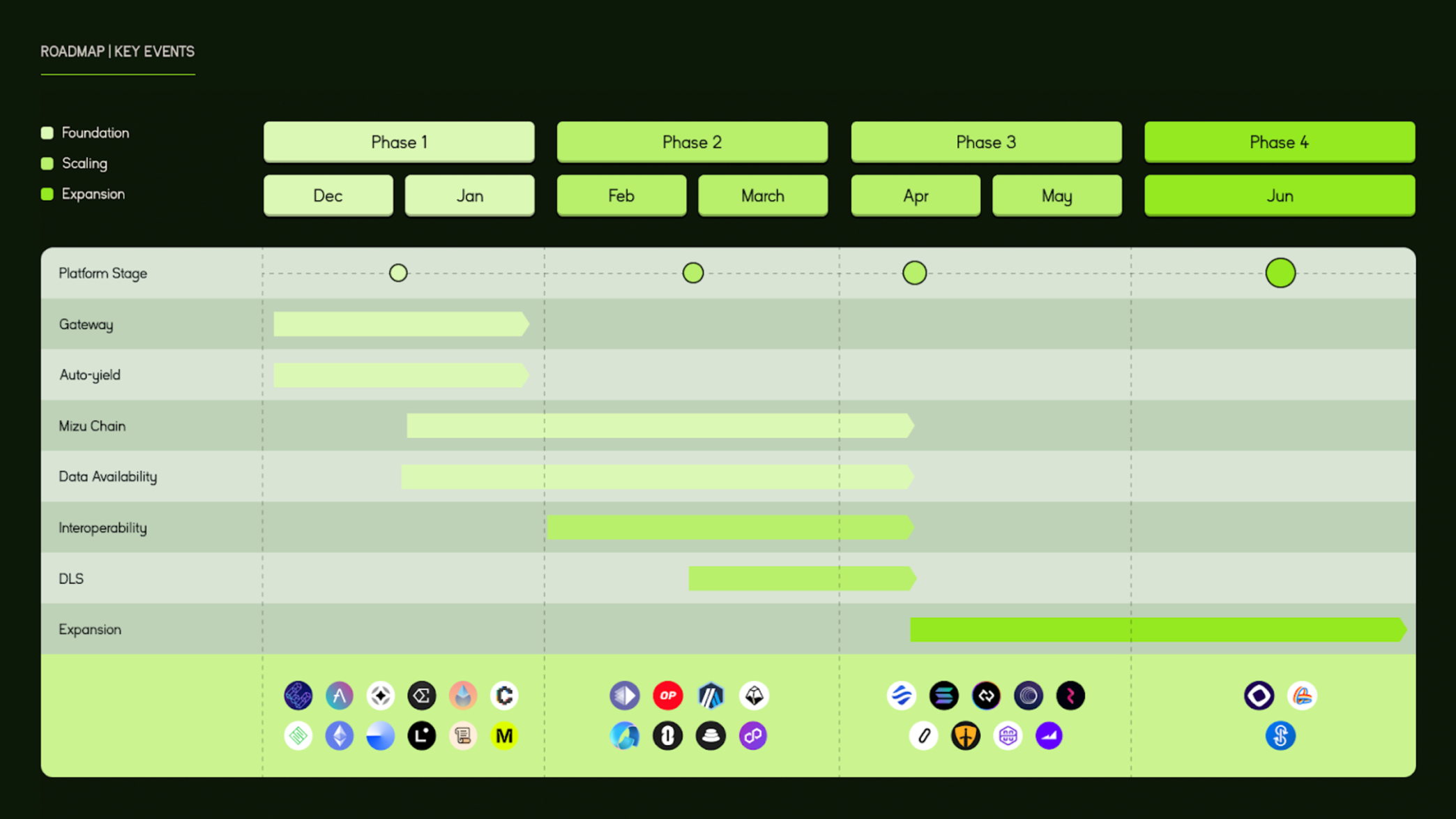

The Road Ahead

Mizu envisions a DeFi future where liquidity flows freely across chains, yield is maximized by default, and artificial barriers between ecosystems disappear.

Get Involved

Join us in building the future of unified liquidity. Follow our development and join our community:

Gitbook: https://docs.mizulabs.xyz/

Community: https://t.me/mizu_labs