Mizu And HyperBeat Launches HyperEVM Vaults

Published: 3/31/2025

Introducing HyperEVM Vaults from Mizu and Hyperbeat

Mizu and Hyperbeat are launching vaults to automate the deployment and optimization of liquidity into top Hyperliquid protocols.

Deposited assets will be bridged to HyperEVM and deployed into partner protocols to earn DeFi yield and rewards from asset issuers such as Resolv, and a share of 1–2% of token supply dedicated to this program from Hyperliquid Ecosystem Partners.

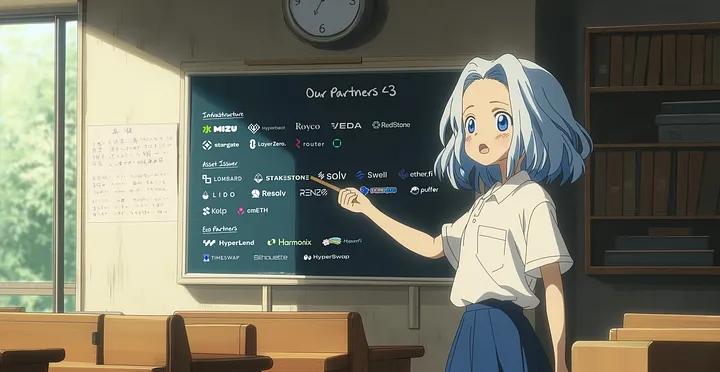

Participating protocols:

Our Partners

Each protocol involved is providing rewards to vault depositors, you can see a breakdown of all the protocols involved below:

Infrastructure

- Mizu Labs

- HyperBeat

- Veda Labs

- Royco Protocol

- Redstone DeFi

- LayerZero

- Router Protocol

- SevenSeas

- Stargate Finance

Asset issuers

- Lombard Finance

- Stake Stone

- Solv Protocol

- Swell Network

- Ether.fi

- Lido Finance

- Resolv Labs

- Renzo Protocol

- Puffer Finance

- Pumpbtcxyz

- mETH Protocol

- Kelp DAO

Hyperliquid Ecosystem Partners

The protocols apart of this liquidity program have been thoroughly vetted to ensure users get direct access to top builders aligned with the ethos of the Hyperliquid ecosystem. All protocols are welcome to join this program provided they satisfy risk and security parameters, as well as providing enough demand for their product to ensure users can continue to access diversified yield opportunities from top Hyperliquid Ecosystem projects.

Why do we do this?

To provide a competitive, yet open & fair environment where the best builders can access liquidity, and users can access otherwise hidden opportunities.

Many new builders face ‘the cold start problem’ where bootstrapping initial liquidity for their protocols is a long, expensive, and extremely high effort process without any guarantees of success.

Some of the challenges faced by builders are:

- A lack of transparency leading to inefficient allocation of incentives

- Not being connected to the right investors, causing a lopsided competitive landscapeExecution risk as a result of reliance on off-chain mechanisms such as legal contracts, hand-shake, and backdoor deals

- Insiders and early “special interest groups” leveraging their outsized positions to get equally outsized backdoor deals

The average user is usually unable to access such opportunities because they’re passed over for professionals, institutions, “special” interest groups, and other privileged actors. Through Mizu’s partnership with Hyperbeat, users can gain access to the Hyperliquid ecosystem and countless, newly-available opportunities.

How it works

Deposit whitelisted assets into a vault to earn rewards from asset issuers — as well as Mizu, Hyperbeat, and Veda points.

There are currently 3 vaults available, providing access to the Hyperliquid ecosystem for BTC, ETH and synthetic USD tokens:

Ethereum — HyperETH Vault whitelisted assets: $rsETH, $ezETH , $cmETH, $weETH, $swETH, $rswETH, $wstETH, $WETH and STONE

Bitcoin — Hyper BTC Vault whitelisted assets: $WBTC, $pumpBTC, $SolvBTC, $LBTC, $cbBTC, $SBTC, $eBTC and $swBTC

USD — HyperUSD Vault whitelisted assets: $USDC, $USDT and $USR

Following deposit of assets to a vault, they are bridged to HyperEVM and deployed into Hyperliquid Ecosystem Protocols:

Assets are moved to HyperEVM through LayerZero and Stargate,with asset issuers utilizing LayerZero’s OFT standard directly on HyperEVM. This enables all assets to be bridged 1:1 to HyperEVM. No slippage. No fees. From there, the assets are availabe on HyperEVM, flooding the HyperEVM ecosystem with liquidity

Users of Mizu vaults can earn yield and rewards from Hyperliquid Ecosystem protocols participating in this program, all of whom have committed between 1–2% of their total token supply for assets allocated to their protocol via the Royco markets deployed as a part of this program.

Deposit now

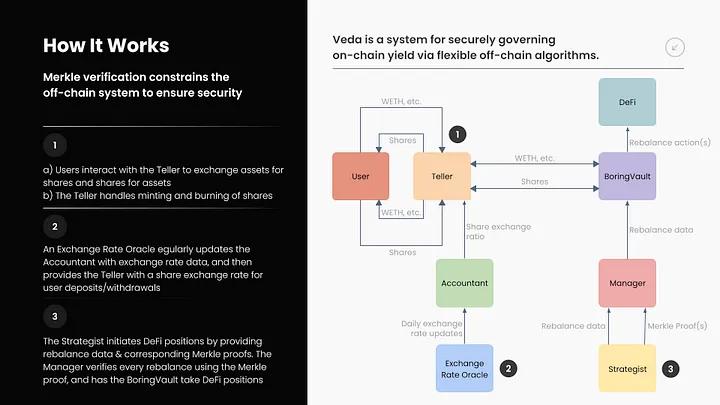

The Mizu Vaults utilize Veda’s BoringVault infrastructure, the most widely used, secure and reputable vault infrastructure in the DeFi space. BoringVaults currently hold billions of dollars of liquidity for top protocols such as Etherfi and Lombard.

The BoringVault infrastructure is a barebones contract that offloads core vault functionality to external, battle-tested contracts. The BoringVault is rebalanced using a Manager, and users can enter & exit the BoringVault using a Teller. BoringVault shares can also optionally run a callback on every transfer & transferFrom function through setting a hook.

BoringVault has made their multiple audits public, view them here.

What is Mizu?

Eigenlayer commoditized trust and security — Mizu commoditizes liquidity and utility.

Designed as the connectivity layer of crypto, Mizu unites all liquidity through vaults to enable liquidity to flow (満ち潮). We believe liquidity is the lifeblood of crypto, yet it’s fragmented and trapped in silos.

Mizu fixes this by:

- Unifying liquidity across ecosystems.

- Optimizing yield through automated strategies

- Maximizing capital efficiency with composable assets

The HyperEVM Vault is the first step for Mizu, giving users early access to yield-optimized liquidity while staying fully integrated with the Hyperliquid ecosystem. Learn more about Mizu.

What is Hyperbeat?

Hyperbeat is a Hyperliquid native protocol that exists to scale HyperliquidX, HyperEVM, and the broader Hyperliquid Ecosystem. Hyperbeat contributes to scaling HyperEVM through:

- The Hyperbeat Hyperliquid node, informally known as ‘HyperP2PBeatio’ was originally launched in July 2024 and now runs in collaboration with P2P.org & Hypio.

- Liquidity Strategies for HyperEVM, starting with our community run HyperEVM pre-launch vault, run in collaboration with Veda and Mizu.

- Hyperstrategy, our treasury run in collaboration with Hypio accumulating $HYPE and other HL-Eco tokens

- Funding and go-to-market support for protocols building on Hyperliquid. Learn more about Hyperbeat.